A Wall Street analyst operates much like the navigator of a vast financial fleet, expertly charting courses through data, markets, and ever-shifting conditions to forecast the trajectories of stocks, bonds, and a spectrum of financial instruments. They assess fair value by weighing countless variables—from company fundamentals to macroeconomic currents—seeking a credible estimate of what a security should be worth given the world as it stands. This guide delves into how analysts reach those value judgments, how their work informs investment decisions, and how modern technology—especially artificial intelligence—interacts with traditional valuation methods to shape trading strategies in today’s markets.

The Analyst’s Toolkit: How Wall Street Pros Determine Fair Value

Wall Street analysts rely on a comprehensive toolkit built from rigorous financial analysis, disciplined modeling, and a wide-angle view of market forces. The objective is not merely to price a stock at today’s value but to forecast a plausible, justifiable price path that reflects both the firm’s intrinsic risk and the broader environment in which it operates. The process is methodical, iterative, and highly data-driven, combining quantitative rigor with qualitative judgment.

First, analysts begin with the company’s core financial statements. They scrutinize revenue streams, earnings, and cash flow to understand how the business generates value. Revenue analysis reveals the drivers of top-line growth: whether it comes from volume, price, new products, or acquisitions, and how durable those drivers are in the face of competition and cyclicality. Earnings illuminate profitability, but analysts look beyond headline figures to factor in cost structure, operating leverage, and non-recurring items that can distort a single period’s sine wave. Cash flow, particularly cash flow from operations, is a critical component because it reflects the company’s ability to fund ongoing operations, pay down debt, invest in growth, and return capital to shareholders.

Beyond the income statement and cash flow, analysts examine the balance sheet to gauge financial health and resilience. They parse the composition of assets and liabilities, the quality of assets, liquidity positions, and the level and composition of shareholders’ equity. Key balance-sheet metrics—such as total assets, the magnitude and structure of debt, interest coverage, and book value per share—provide a window into balance-sheet strength and the potential for future capital needs or stress under adverse conditions.

A crucial step is assessing trends over time. Analysts track revenue growth trajectories, trends in operating margins, and the trajectory of earnings per share (EPS). They examine whether margins are expanding due to pricing power or cost reductions, or whether they are under pressure from input costs, competitive dynamics, or regulatory changes. The assessment of growth sustainability includes consideration of research and development, capital expenditures, and the effectiveness of management in translating strategic plans into measurable gains.

Next, analysts perform a deep dive into ratios and relative valuation. They compute and interpret a battery of metrics, including but not limited to:

- Price-to-Earnings (P/E) Ratio: Indicates how the market values the company’s earnings, reflecting expectations about growth, risk, and capital discipline.

- Price-to-Sales (P/S) Ratio: Measures the stock price relative to the company’s revenue, useful for evaluating firms with volatile earnings or negative profits.

- Price-to-Book (P/B) Ratio: Compares the stock price to the company’s book value per share, offering insight into how the market prices net assets.

- Debt-to-Equity Ratio: Evaluates the company’s leverage and financial risk relative to shareholders’ equity.

- Return on Equity (ROE): Gauges how efficiently the company uses shareholder capital to generate profits.

- Dividend Yield: Assesses the payout relative to the stock price, indicating the cash-on-cash return investors can expect from dividends.

The aim of this ratio work is to triangulate a stock’s fair value by comparing it to historical norms, sector peers, and the broader market. Analysts ask whether a stock is undervalued or overvalued on a relative basis, given its growth profile, risk, and capital allocation efficiency. A key element of this analysis is situating the company within its industry—evaluating market share, competitive advantages, and barriers to entry that influence pricing power and growth potential. In addition to relative metrics, many analysts employ discounted cash flow (DCF) analysis to estimate intrinsic value. In a DCF, future cash flows are projected and then discounted back to the present using an appropriate discount rate to reflect risk and the time value of money. The resulting intrinsic value acts as a benchmark against which market prices can be evaluated.

Industry positioning and competitive dynamics are central to a fair- value assessment. Analysts ask questions about the company’s competitive moat, scale advantages, customer concentration, and the sustainability of its business model. They consider the broader industry lifecycle, regulatory backdrop, and macroeconomic conditions that may alter demand, pricing, and the cost of capital. This holistic view helps ensure that valuation doesn’t hinge solely on one-off metrics or a favorable quarter, but on durable drivers of value.

Information gathering is a dynamic exercise. Analysts synthesize findings from multiple sources to refine their estimates. They dig into conferences, management discussions, and public filings; they read research notes, industry reports, and market data; they monitor earnings calls for management tone, guidance, and strategic pivots. They also scrutinize the competitive landscape—benchmarking against peers to gauge relative strength, vulnerabilities, and potential catalysts that could alter fair value. The analytic journey is iterative: new data prompts revisions to forecasts, which in turn influence valuation conclusions.

To translate data into actionable expectations, analysts compute a broad set of metrics across scenarios. They generate base-case assumptions, optimistic (bullish) scenarios, and pessimistic (bearish) scenarios to understand the range of fair values and the risk-reward balance. They test sensitivities to key inputs such as revenue growth rates, profit margins, capital expenditures, and changes in the discount rate. The outcome is a spectrum of potential prices, anchored by a disciplined narrative about why the stock could move within that range.

Finally, interaction with the real world remains essential. Analysts often talk to company management, attend investor conferences, and read a wide array of research reports to glean information not fully captured in public filings. This information-gathering cadence supports a more nuanced view of risk and opportunity, ensuring forecasts reflect current realities, strategic plans, and evolving market conditions.

It is important to acknowledge that even the best analysts operate under certainty limits. Forecasts are inherently probabilistic, shaped by evolving industry conditions, macro shocks, and unexpected events. Analysts’ predictions can be wrong, and market prices can deviate from their estimates. Still, the value of their work lies in disciplined, transparent methodologies, consistent processes, and the willingness to revise views as evidence changes. For investors, the analyst’s fair-value estimate provides a critical benchmark to guide decisions, manage risk, and calibrate expectations.

Coverage Scope and Market Focus: What Analysts Watch—and Why

Analysts don’t study every asset with equal intensity. They selectively focus on areas that are most likely to yield reliable insights, provide liquidity, and offer meaningful opportunities for investment decisions. This selective coverage is shaped by resource constraints, market demand, and the practicalities of comparative analysis.

First, the universe of assets most commonly scrutinized consists of publicly traded equities, sectors, and Exchange-Traded Funds (ETFs) that offer transparent pricing, robust liquidity, and accessible data. Large-cap firms with well-established operating histories attract sustained attention because their performance is easier to model, their data is plentiful, and trading activity ensures price discovery remains efficient. Liquidity matters because it reduces trading costs, enables timely risk management, and improves the reliability of price signals used in valuation and forecasting.

In contrast, certain asset classes have historically received less analyst attention. Penny stocks and a majority of small-cap securities may attract limited coverage due to higher volatility, thinner trading volumes, regulatory complexity, and greater information dispersion. The scarce liquidity makes precise valuation and risk assessment more challenging, increasing the likelihood that forecasts will be revised frequently and unpredictably. Analysts therefore tend to concentrate on assets where data quality, price transparency, and the investor base support rigorous, repeatable analyses.

The selection of sectors and industries for coverage is dynamic. Analysts emphasize dynamic, high-impact sectors—such as technology, healthcare, and finance—where growth drivers are identifiable and where companies’ earnings prospects are highly scrutinized by investors. They study sectors characterized by rapid innovation, regulatory shifts, or meaningful macro cycles, which can drive volatility and trading opportunities. A sector that is growing quickly or experiencing transformational change often commands deeper research because its implications can ripple through related firms, suppliers, competitors, and capital markets.

Within sectors, analysts assess companies based on several criteria that determine their likelihood of becoming part of a research universe. A primary criterion are high liquidity and broad market visibility, which facilitate consistent valuation and easy comparison with peers. A company’s market capitalization is a practical proxy for this priority; larger, more liquid firms are more likely to attract sustained coverage, while smaller, illiquid firms may be added only if they display unique catalysts—strong earnings momentum, significant strategic changes, or compelling corporate actions—that promise measurable impact on value.

Beyond size and liquidity, analysts consider “brand and reputation” factors. This includes a firm’s public profile, leadership quality, governance standards, historical earnings consistency, and the existence of meaningful strategic milestones. Firms known for transparent reporting and reliable disclosures tend to draw more attention because the quality and timeliness of information underpin robust valuation, scenario analysis, and risk assessment.

Catalysts are another crucial determinant in coverage decisions. Analysts monitor what could shift fair value—such as earnings surprises, product launches, regulatory developments, capital-structure changes, mergers and acquisitions, and major management shifts. A sector or company that is frequently affected by catalysts in the near term will naturally attract more analytical attention, as these events can create significant trading opportunities or heightened risk.

Unique features and structural advantages also guide analyst coverage. Shelf-life of the business model, competitive moat strength, recurring revenue models, and the breadth of the addressable market can influence whether a firm earns ongoing attention. The most robust candidates for coverage typically possess a combination of stable cash flows, scalable growth opportunities, and a track record of prudent capital allocation.

Finally, the demand landscape—both from institutional and retail clients—shapes who covers what. Analysts respond to client interest in specific names, sectors, or investment themes. Client demand can drive broader coverage or intensify emphasis on certain stocks or industry trends, reinforcing the alignment between research outputs and investor needs.

In practice, the analyst’s coverage decisions also reflect a careful balance between the need for comprehensive market intelligence and the necessity to avoid over-diversification that would thin out research quality. Concentrated coverage of key drivers, credible data, and credible forecasts enhances the reliability of a firm’s fair-value estimates and makes it easier for investors to interpret and act on research findings. The aim is to provide clear, actionable insights that anchor investment decisions in solid data, while maintaining the flexibility to revise views as new information arrives.

From Estimates to Insights: Using Consensus and AI in Modern Markets

One of the enduring contributions of Wall Street analysts is the production of consensus estimates—aggregated price targets, earnings forecasts, and growth projections that reflect the collective view of multiple analysts. The consensus acts as a benchmark that helps investors gauge the market’s sentiment, assess the balance of risks and opportunities, and understand where the majority of experts think a stock is headed over a specific horizon.

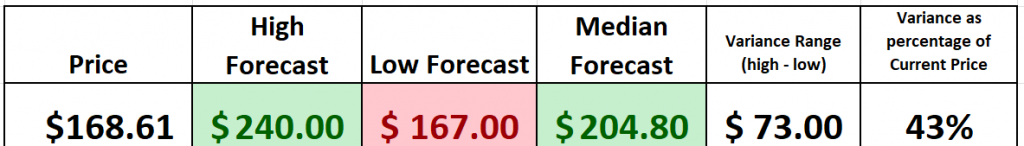

Key to using consensus effectively is understanding the dispersion around estimates—the range between the most bullish and most bearish projections, and where the median sits relative to the current price. Analysts often compile a spread of targets and forecasts to illustrate confidence levels and potential volatility in forward pricing. This dispersion, or variance, provides insight into how much disagreement exists about a stock’s future path, which in turn informs risk management and position sizing.

A practical approach to employing consensus begins with collecting a sample of price targets and note the following:

- The number of analysts contributing to the estimate.

- The average or consensus 12-month price target.

- The highest and lowest price targets in the set.

- The median price target, which can be less influenced by outliers than the mean.

- The current price of the stock to assess how far the market price sits from the consensus targets.

With this data in hand, investors can compute key comparisons. For example, by comparing the current price to the most bullish forecast and to the most bearish forecast, one can measure the dispersion in expectations. This difference—the price target spread—can be interpreted as a proxy for the market’s uncertainty about the stock’s near-to-mid-term trajectory. A wider spread suggests greater disagreement on future value and often implies higher risk or greater volatility, depending on how price action aligns with those forecasts.

The consensus estimate also offers a way to juxtapose price action with forecasting realities. Investors can analyze how the current price interacts with the consensus target, and they can compare price movement to median and mean targets to understand whether the market is pricing in the majority view or pricing in additional risk or upside beyond the consensus.

In modern markets, artificial intelligence and machine learning increasingly augment traditional analyst methodologies. AI systems can rapidly synthesize large datasets, including company fundamentals, macroeconomic indicators, sentiment indicators, and historical price patterns, to generate predictive insights that complement human judgment. The synergy between human analysts and AI produces richer decision-making frameworks, where quantitative signals from machine learning models are interpreted through the lens of fundamental analysis and market context.

To illustrate the interplay between consensus estimates and real-world data, consider a representative case study often discussed by traders: Apple Inc. (AAPL). Suppose a snapshot shows Apple trading at a specific price, while a consensus of many analysts provides a 12-month target that is higher than the current price, with a spectrum of bullish, median, and bearish forecasts. In such a scenario, practitioners can construct a framework that compares the price to the consensus targets, evaluates how far current price is from the most optimistic forecast versus the most pessimistic forecast, and assesses whether the price is nearer to the lower bound of the forecast range. This kind of grid helps to answer practical questions: Is the market price already discounting the most bearish view, or does it imply further downside or upside in line with expectations? How does the current price relate to the median forecast? Is the price action consistent with the longer-term trend implied by the consensus?

Beyond simple comparisons, the integration of AI into this workflow enhances decision-making. AI systems can track momentum, volatility, and regime shifts, delivering signals that highlight whether the price action supports the consensus view or diverges in meaningful ways. When used responsibly, AI augments the analytic toolkit by offering pattern recognition, anomaly detection, and scenario testing at scales far beyond human capability, while still requiring human oversight to validate assumptions and manage risk.

The practical value of consensus estimates grows when combined with robust risk management and disciplined strategy. Traders and investors who study the consensus alongside current prices, trend indicators, and AI-driven signals can craft more informed trading plans. They can adjust position sizes, set stop losses, and manage exposure to sectors or themes that appear vulnerable to changing conditions. The most effective participants do not rely solely on forecasts; they integrate forecast data with price action, liquidity considerations, and risk controls to navigate the markets with greater resilience.

Apple serves as a concrete example of how this analytic framework plays out in real time. Analysts often publish diverse targets based on differing assumptions about growth, margins, and product cycles. The resulting consensus, together with the dispersion of estimates, creates a structural map of forward-looking expectations. Investors can compare this map with the stock’s recent price action, evaluating whether the market is already pricing in the consensus or if there is a mispricing opportunity that could be exploited with sound risk controls. In an AI-assisted approach, traders may use machine learning tools to quantify the relationship between target dispersion and subsequent price movements, testing how well historical patterns align with current data to inform future decisions.

Despite the value of consensus estimates, it is essential to recognize that analysts are not infallible. Forecasts are subject to revision as new information arrives, and unexpected events can alter trajectories in ways that no one could fully anticipate. AI models likewise have limitations and depend on the quality of input data, model assumptions, and the time horizon under consideration. The strength of an integrated approach lies in acknowledging these limitations, continuously updating data inputs, and maintaining a disciplined process that blends quantitative signals with qualitative judgement.

In practice, AI-enabled analysis can reinforce a trader’s ability to stay aligned with the prevailing trend while remaining mindful of potential turn points. The predictive blue line and similar indicators (when used responsibly) can help identify the direction and strength of a move, while consensus estimates provide a fundamental frame for understanding what the market expects. By combining these elements, investors can improve decision-making, calibrate risk, and pursue opportunities with a more systematic, evidence-based approach.

AI and Modern Trading: The Union of Human Insight and Machine Intelligence

The future of trading increasingly lies at the intersection of human expertise and advanced technology, where neural networks, machine learning, and broad AI capabilities enhance the efficiency and depth of market analysis. Artificial intelligence is not a mere instrument of automation; it represents a fundamentally different way of processing information—one that can uncover patterns, test hypotheses, and adapt to new data streams with remarkable speed and scale.

In the realm of valuation, AI contributes in several transformative ways. First, AI accelerates the synthesis of vast data sets. Analysts must digest quarterly earnings, regulatory filings, market data, industry reports, macroeconomic indicators, and a continuous stream of news and social signals. AI systems can ingest and harmonize these inputs, identify relevant signals, and rank them by their likely impact on a company’s value. This capability reduces the time required to surface meaningful insights and frees analysts to focus on interpretation, narrative-building, and scenario analysis.

Second, AI facilitates more robust scenario planning and sensitivity testing. Traditional valuation relies on a handful of forecast scenarios, but machine learning models can generate a much larger array of plausible futures, weighted by probability. Analysts can examine how intrinsic value shifts under different macro regimes, competitive dynamics, and consumer behavior, helping investors understand the probability distribution of outcomes and the associated risks. This probabilistic perspective is particularly valuable in volatile markets where tail risks can be significant.

Third, AI supports trend detection and momentum analysis. By analyzing historical price action, volatility patterns, and cross-asset correlations, AI can help traders identify regimes in which price movements are more predictable or more erratic. These insights allow for more precise timing and risk management, including dynamic adjustments to position sizing and hedging strategies as conditions evolve.

Fourth, AI enhances decision transparency and reproducibility. Well-designed AI tools document the data inputs, modeling assumptions, and decision pathways that lead to a trading signal or forecast. This traceability helps analysts and traders hold their strategies to rigorous standards, facilitates backtesting, and supports better governance over investment processes.

However, AI’s benefits come with caveats that require careful navigation. AI outcomes depend on the quality of data and the appropriateness of models for the problem at hand. If data inputs are noisy or biased, AI forecasts may mislead rather than inform. The dynamic nature of markets means models require regular recalibration and validation to ensure they remain aligned with current conditions. There is also a risk of overfitting where models capture historical noise rather than durable relationships, causing performance to deteriorate in new environments. Therefore, AI should complement, not replace, human judgment. The best practitioners blend machine-driven signals with fundamental analysis, intuitive understanding of business models, and an awareness of macro forces.

The practical question for traders is how to integrate AI into their existing research and trading process without losing essential context. A prudent approach starts with a clear objective: what decision will AI help you make, and what is the role of human review in that decision? From there, it’s important to establish robust data governance, including data quality checks, version control, and transparent performance metrics. Importantly, AI should be used to enhance decision speed and depth while maintaining rigorous risk controls, such as diversified portfolios, stop-loss mechanisms, and regular performance audits that examine both wins and losses.

In this evolving landscape, neural networks and machine learning systems are employed to recognize complex patterns in historical data that might elude human observers. They can capture nonlinear relationships, interactions among variables, and time-varying effects that are difficult to model with traditional approaches. When used to augment analysis, AI can help technical teams identify more precise entry and exit points, quantify uncertainty, and simulate a broader array of futures than would be feasible manually.

The broader impact of AI in trading is not limited to price forecasting alone. AI-driven analytics extend to risk management, portfolio construction, and even the design of trading strategies. By analyzing risk factors across factors such as liquidity, volatility, and correlation with other assets, AI tools can help construct portfolios that optimize expected return given a defined risk budget. For institutions, AI contributes to more disciplined execution, improved operational efficiency, and enhanced ability to uncover and capitalize on short- and medium-term opportunities.

Nevertheless, the human element remains indispensable. Successful trading requires not only the right signals but also the ability to interpret those signals in the context of business strategy, competitive dynamics, and regulatory considerations. Analysts and traders must maintain ethical standards, adhere to risk governance, and continuously validate models against real-world outcomes. The synergy between human intellect and AI power is where the most resilient investment approaches today are formed—where data science informs decision-making, and human judgment refines and contextualizes the conclusions drawn by machines.

Practical Framework: Turning Analyst Data into Actionable Trades

For investors seeking to translate the insights from analysts, consensus estimates, and AI signals into practical trading plans, a structured, repeatable framework is essential. The goal is to balance analytical rigor with disciplined risk management, ensuring decisions are grounded in evidence while preserving the flexibility to adapt to changing market conditions.

-

Establish a valuation baseline. Begin by gathering fundamental data—revenue, earnings, margins, and cash flow—from the company’s latest filings and management commentary. Evaluate growth drivers, competitive dynamics, and macro factors that could influence future performance. Build a base-case projection that reflects the most probable path given current conditions, while acknowledging uncertainties.

-

Compile consensus and compare with the price. Collect the latest consensus estimates, 12-month price targets, and the dispersion of forecasts from a representative sample of analysts. Compare the current stock price to the consensus targets, focusing on the distance to the most bullish and most bearish forecasts and the median target. Use this comparison to gauge whether the market is pricing in a particular scenario or if there may be mispricing opportunities.

-

Assess the price-versus-forecast gap. Analyze how far the stock’s current price is from the most positive forecast, the most negative forecast, and the median forecast. Consider the variance between forecasts as a risk–reward signal: a large spread can indicate higher uncertainty but also higher potential rewards if the price reverts toward the consensus as new information arrives.

-

Integrate AI-driven signals with price action. Use AI tools to examine trend strength, momentum, and regime shifts. Cross-reference AI signals with price behavior around levels highlighted by analysts’ forecasts. Look for alignment or divergence between what AI indicates and what consensus implies, and explore how the pattern of price action around target levels informs potential entry or exit points.

-

Evaluate current trend and risk controls. Determine the prevailing trend based on price action and AI indicators. If the trend aligns with the consensus path and risk tolerances permit, consider a position that respects the trend’s direction and pace. Implement risk controls such as stop losses, position sizing rules, and hedging strategies to manage downside risk.

-

Factor in liquidity and execution considerations. Ensure that the chosen assets have enough liquidity to execute planned trades without substantial market impact. Consider the spread, trading hours, and potential slippage when sizing positions or entering trades, particularly in high-volatility environments.

-

Build a narrative that ties fundamentals to market signals. Create a coherent story explaining why the price should move toward a particular target, incorporating both the company’s fundamentals and macro conditions. This narrative should incorporate the analyst consensus, the AI-driven trend signal, and the observed price action to justify a defined trading plan.

-

Monitor, learn, and adjust. Markets evolve, so regularly revisit assumptions, update forecasts, and revise risk controls as new information becomes available. Maintain a disciplined process for reassessment and learn from both successful trades and losers to improve future decision-making.

A practical implication of this integrated approach is the possibility of using AI to inform where to focus attention while leveraging human judgment to interpret the results and manage risk. The hope is not to rely on a single source of truth but to synthesize multiple perspectives—analyst consensus, AI-driven signals, and real-time market data—into a coherent framework that supports better-informed trading decisions.

The Apple case study often cited by practitioners illustrates this approach in action. Consider the six-month price action of Apple (AAPL) alongside a long-term predictive AI analysis line. Analysts may publish a consensus estimate around a specific fair value, with a median target that is higher than the current market price. The dispersion of forecasts across bullish, bearish, and neutral outcomes offers a roadmap of potential trajectories. A trader can chart a practical course by comparing these targets to the actual price and observing how the stock behaves near the most pessimistic forecast level. If the price hovers near that level and the AI trend remains negative, it might suggest a continued downside bias unless new information or catalysts emerge. Conversely, if price action proves resilient and AI indicators confirm a shift in momentum, the risk-reward equation could tilt toward the upside premise.

The six-month performance path for a stock like Apple often reveals a sequence of forecast updates, with each new data point prompting a recalibration of the fair-value estimate by analysts. In practice, traders will map out the most probable outcomes, then observe how actual price action aligns or diverges from these expectations. A robust framework will account for both the consensus and the actual market response to incoming information, while AI signals provide a dynamic, quantitative view of trend and momentum that complements narrative-driven fundamental analysis.

In this ecosystem, the relationship between human expertise and AI helps markets function more efficiently. Analysts contribute depth, context, and a disciplined valuation process, while AI offers speed, pattern recognition, and probabilistic reasoning across expansive data sets. The resulting combination supports investors in making more informed decisions, mitigating some of the biases and cognitive limitations that can affect individual judgment. It also helps traders adapt to rapid changes in market dynamics, ensuring that strategies remain aligned with the latest information and price action.

Yet it remains essential to exercise prudent discernment. Even the most sophisticated AI systems, when paired with high-quality data, do not guarantee profits. Market conditions can shift abruptly due to macro shocks, regulatory changes, or unforeseen events that alter risk profiles and render prior forecasts outdated. A balanced approach emphasizes diversification, risk management, and continuous learning. Investors should remain skeptical of any single forecast or signal and instead rely on a holistic framework that integrates fundamental analysis, consensus estimates, and AI-driven insights within a disciplined risk-control environment.

In summary, the future of trading lies in the synergy between human intelligence and machine intelligence. Analysts provide a rigorous, methodical approach to fair-value estimation, anchored in financial fundamentals and market context. AI complements this discipline by enabling faster data processing, broader scenario exploration, and more nuanced pattern recognition. Together, they offer a powerful toolkit for navigating complex markets, identifying meaningful opportunities, and managing risk with greater precision.

The Trail to Action: How Traders Use Analyst Insights and AI in Real Time

To translate these ideas into practical steps that traders can apply, consider a structured workflow that integrates analyst outputs with AI-driven information while remaining cognizant of risk and market dynamics.

-

Gather and normalize inputs. Compile the latest analyst forecasts, price targets, and consensus estimates for the asset. Collect current price information, volume data, and relevant macro indicators. Normalize the data so that different sources can be compared on a like-for-like basis, reducing the risk of misinterpretation caused by different reporting conventions.

-

Benchmark current price against targets. Compare the present price to the consensus, median, and extreme forecasts to assess where the market stands relative to expert expectations. Note the spread between forecasts and the gap to the current price as a proxy for uncertainty and potential volatility ahead of revisions.

-

Weigh AI trend signals against fundamentals. Evaluate AI-generated signals—such as momentum, volatility regimes, and price-path forecasts—and determine whether they corroborate or contradict the analyst-based fair-value narrative. When AI and fundamentals align, the case for a position becomes stronger; when they diverge, a cautious approach with heightened risk controls is warranted.

-

Assess key support and resistance levels. Identify price levels around which the stock has historically found buying or selling pressure, particularly near forecast targets. Monitor how price behaves when approaching these levels, looking for confirmations from AI signals and earnings guidance, or catalysts that could push the price through or fail to break those thresholds.

-

Define a trading plan with risk controls. Develop a plan that includes entry criteria, target price levels, stop-loss placement, and risk limits. The plan should reflect the degree of uncertainty implied by the forecast dispersion and the AI-driven assessment of trend strength. Ensure the plan accommodates possible adverse events and includes predefined exit strategies based on price action and risk tolerance.

-

Execute thoughtfully and monitor continuously. Implement the trade with careful consideration of liquidity and execution costs. Maintain ongoing oversight of price movement, updating AI signals and analyst commentary as new data arrives. Reassess forecasts and adjust risk parameters if the underlying assumptions shift.

-

Review performance and refine the approach. After the trade, analyze what worked and what did not. Compare realized outcomes with the original forecasts and AI predictions to identify biases, model limitations, and areas for improvement. Use those insights to fine-tune inputs, scenarios, and risk controls for future trades.

The practical takeaway is clear: analysts provide valuable fair-value estimates grounded in fundamental analysis, while AI adds depth, breadth, and speed to the evaluation process. Trading strategies that successfully combine these elements can better navigate the complexities of modern markets, benefiting from disciplined valuation, data-driven insights, and rigorous risk management.

The Road Ahead: Trading Mastery Through Knowledge, Discipline, and Technology

The discipline of trading—whether for individual investors or large institutions—depends on a careful blend of knowledge, strategy, and execution. Analysts’ work remains central to understanding fair value and guiding informed investment decisions across a broad range of assets, from individual stocks to sectors and ETFs. Their insights help illuminate the complexity of markets and provide a framework for evaluating risk and opportunity in a world where information is abundant and prices respond to a rapidly changing environment.

Artificial intelligence and machine learning are reshaping how this knowledge is applied. They extend the reach of traditional valuation by enabling deeper data synthesis, broader scenario exploration, and more agile decision-making. The future of trading is therefore likely to be characterized by closer collaboration between human expertise and machine intelligence—where rigorous fundamental analysis informs AI-driven signals and where automated systems amplify, not replace, the critical thinking that underpins sound investment judgments.

Investors who embrace this integrated approach can expect to gain a more nuanced, resilient understanding of fair value and trading opportunities. By combining analyst consensus with AI insights, traders can navigate volatility, capitalize on trends, and manage risk with greater precision. Yet the essential caveat remains: markets are dynamic and uncertain. Robust risk management, continuous learning, and prudent diversification are indispensable components of any approach that seeks to harness the power of analytic rigor in a technology-enabled environment.

Conclusion

In the complex world of finance, Wall Street analysts function as navigators who chart a course through mountains of data, sector dynamics, and macro forces to form educated judgments about fair value. Their methodologies—rooted in careful examination of financial statements, margin and growth analysis, balance-sheet scrutiny, and sophisticated ratio and valuation techniques—provide a foundational framework for assessing a stock’s intrinsic value. The work is complemented by an understanding of competitive positioning, entry barriers, and industry structure, all of which influence a company’s long-term prospects.

Analysts’ coverage patterns reveal strategic choices about which assets, sectors, and catalysts warrant attention, prioritizing liquid, well-known, and influential securities while acknowledging the realities of the market for smaller, less liquid names. Consensus estimates, volatility in forecasts, and the dispersion of targets give investors a sense of market sentiment and risk, while AI and machine learning offer a powerful enhancement to traditional analysis by delivering rapid data synthesis, scenario testing, and predictive signals at scale. The strongest approaches combine human expertise with AI-driven insights, producing more robust decisions that account for both fundamental drivers and evolving market dynamics.

For traders and investors, the practical synthesis is straightforward: use analyst-provided fair-value estimates as a guide, illuminate the range of possible outcomes, and then couple that with AI-driven trend analysis and disciplined risk management to inform action. Price action around key forecast levels, the prevailing market trend, and the reliability of inputs all shape the ultimate decision. The goal is not to chase precision in a perpetually uncertain environment but to pursue disciplined, evidence-based strategies that align with the best information available and adapt as conditions change.

In a world where technology accelerates every aspect of market analysis, the partnership between human judgment and machine intelligence stands as the strongest foundation for navigating the financial seas. By embracing rigorous research, careful interpretation of consensus forecasts, and responsible use of AI tools, investors can strive to identify meaningful opportunities while safeguarding capital in an ever-evolving landscape. The journey toward more informed, data-driven trading is ongoing, and its value lies in the disciplined integration of enduring financial principles with the transformative capabilities of modern technology.