With the United States tightening export controls on advanced semiconductors used for artificial intelligence development, China is intensifying bets on domestic alternatives, led by Huawei. Beijing has faced a multi-layered challenge: the same restrictions that block access to the world’s most advanced chips also curb access to core technology essential for building a robust AI chip ecosystem. The constraint spans the entire semiconductor value chain—from chip design and manufacturing equipment to supporting memory components. In response, Beijing has mobilized substantial financial resources—tens of billions of dollars—to close the gaps. While these efforts have yielded some breakthroughs through determined, brute-force experimentation, experts say the path to a fully self-reliant AI chip ecosystem remains long and arduous.

In this landscape, several strategic questions shape China’s trajectory: How does the country stack up against global leaders in four critical segments required for AI chip creation? What progress has Huawei’s HiSilicon made in chip design compared with Nvidia, and what are the limits to domestic fabrication? How constrained is China by the export-control regime when it comes to high-end lithography and other essential manufacturing equipment? And what role does memory—particularly high-bandwidth memory—play in enabling competitive AI accelerators at scale? Analysts argue that while China is narrowing some gaps, the overall ecosystem still relies heavily on foreign technology and suppliers, creating a delicate balance between rapid domestic development and continuing dependence on external capabilities.

AI chip design

Nvidia sits at the pinnacle of AI chip design, widely recognized for its leadership in graphics processing units engineered for AI training and inference. Yet, it’s important to note that Nvidia does not manufacture the physical chips it designs. Instead, the company develops GPU architectures and designs that are then sent to contract manufacturers—often called foundries—for mass production. In practice, Nvidia’s GPUs set the industry standard for performance and efficiency, and the demand for its chips remains exceptionally robust across customers that run large-scale AI workloads, including data centers, research labs, and enterprise AI initiatives.

Despite Nvidia’s dominance in design, the company faces mounting export controls in the United States that constrain its ability to sell the most advanced products into China. In particular, restrictions introduced in recent months have curbed sales of certain Nvidia GPUs to Chinese clients, including some variants designed to evade earlier controls. These policy measures are not just about halting sales of the most powerful accelerators; they also alter the competitive landscape by creating space for alternative suppliers and spurring domestic development. In the Chinese market, customer demand has shown a strong appetite for any Nvidia designs that can be legally acquired, illustrating the market’s willingness to import high-end GPUs whenever restrictions allow.

Against this backdrop, Chinese players have accelerated efforts to forge domestic alternatives in response to the export controls. A broad set of entrants—ranging from established firms to ambitious startups—has entered the AI processor arena, aiming to fill the demand void left by Nvidia’s constrained access. Among these participants, several new entrants have raised billions of dollars in funding and are positioning themselves to capture a portion of the GPU replacement cycle that occurs when access to Nvidia products is restricted or limited. While these Chinese entrants are moving rapidly, they are still learning to scale production, optimize performance, and close the gap to world-leading Nvidia architectures.

In this competitive race, Huawei’s HiSilicon stands out as a focal point for domestic ambitions. Huawei’s Ascend family has evolved from earlier generations into more advanced silicon, with the Ascend 910B as its most mature GPU in mass production and the Ascend 910C anticipated to begin mass shipments in the near term. Analysts observe that while Huawei’s latest designs do not yet surpass Nvidia’s latest export-restricted offerings, they demonstrate meaningful progress and a closer distance to Nvidia’s capabilities than before. The performance gap between Huawei’s Ascend 910-series GPUs and Nvidia’s restricted chips is narrowing, according to independent observers, suggesting that Huawei is closing in on a competitive position for China’s domestic market.

Industry analysts emphasize that design is only one critical component of building a competitive AI chip ecosystem. Even as Huawei makes strides in architectural design, the broader ecosystem must evolve in tandem with fabrications, packaging, software stacks, and system integration. The design stage feeds directly into the broader chain of manufacturing and assembly, and it requires a deep pool of software, compilers, and optimization tools to unlock the full potential of the silicon. As a result, even as Huawei closes some of the performance gaps, the remaining hurdles are far-reaching and multifaceted, spanning reliability, power efficiency, heat dissipation, and ecosystem compatibility with global AI frameworks.

Dylan Patel, an analyst focused on AI hardware, notes that while Huawei’s Ascend family shows substantial progress, it remains behind Nvidia’s designs in raw performance metrics. He points out that the 910B lags Nvidia’s top offerings by a generation in terms of readiness for the most demanding workloads, and the Ascend 910C is still within a single generation of Nvidia’s capabilities. Yet Patel emphasizes a broader takeaway: the momentum in China’s domestic design efforts signals a significant shift in the competitive landscape, moving away from a sole dependency on foreign suppliers toward an increasingly capable domestic champion.

Looking ahead, the design race in China is likely to be shaped by continued investment in AI-specific software ecosystems, optimization toolchains, and cross-disciplinary collaboration between chip designers, software developers, and AI researchers. The presence of an expanding Chinese ecosystem—comprising startups, established hardware and software firms, and academic research communities—suggests a durable push toward self-reliance in the design of AI accelerators. However, it is essential to recognize that bridging the gap to Nvidia’s elite designs will require not only architectural innovation but also progress in manufacturing scalability, process technology, and the availability of advanced materials and equipment.

To summarize this section, Nvidia remains the benchmark for AI chip design, but China’s domestic efforts—especially through Huawei’s HiSilicon—are steadily advancing. The relative gap is being reduced, albeit with a long runway still ahead before a truly self-sufficient Chinese AI chip design ecosystem can rival the most advanced foreign architectures at scale. The interplay between export controls, domestic policy support, and the accelerating ambitions of Chinese firms will continue to shape the trajectory of chip design leadership in the coming years. This dynamic underscored the imperative for China to build not only competitive GPU architectures but also the broader software, development tools, and ecosystem support necessary to maximize performance on available hardware.

Subsection: The architecture and toolchains that power AI design

In the broader context of AI chip design, architecture choices—such as matrix-multiply efficiency, memory bandwidth integration, neural network fusion, and tensor core optimizations—are central to achieving high throughput and low latency in AI workloads. The design of a modern AI accelerator goes beyond raw transistor counts; it requires deep integration with compilers, programming models, and runtime systems that can exploit hardware capabilities efficiently. This is where the domestic Chinese ecosystem is racing to establish competencies that rival the established software toolchains of leading global players.

China’s aim is to cultivate a robust software stack and developer ecosystem that can unlock the potential of its domestic GPUs, much as Nvidia’s CUDA framework and associated libraries empower a vast external developer community. The development of native AI frameworks, compilers that optimize code for Huawei’s Ascend architectures, and partnerships with universities and research institutions are all seen as critical to closing the loop between hardware and software. Analysts expect continued investment in compiler research, AI-specific programming abstractions, and standardized benchmarks that can demonstrate the competitiveness of domestic chips on a variety of workloads.

In summary, the AI chip design segment remains a defining battleground in China’s push for semiconductor self-reliance. Nvidia’s leadership in design remains unchallenged in the near term, but Huawei’s progression with Ascend GPUs and the emergence of other domestic players are reshaping the competitive dynamics. The combination of accelerating domestic design capability and a strategic emphasis on ecosystem development could ultimately yield a more diversified landscape, where China is less dependent on foreign suppliers for AI accelerators and the software ecosystem that powers them.

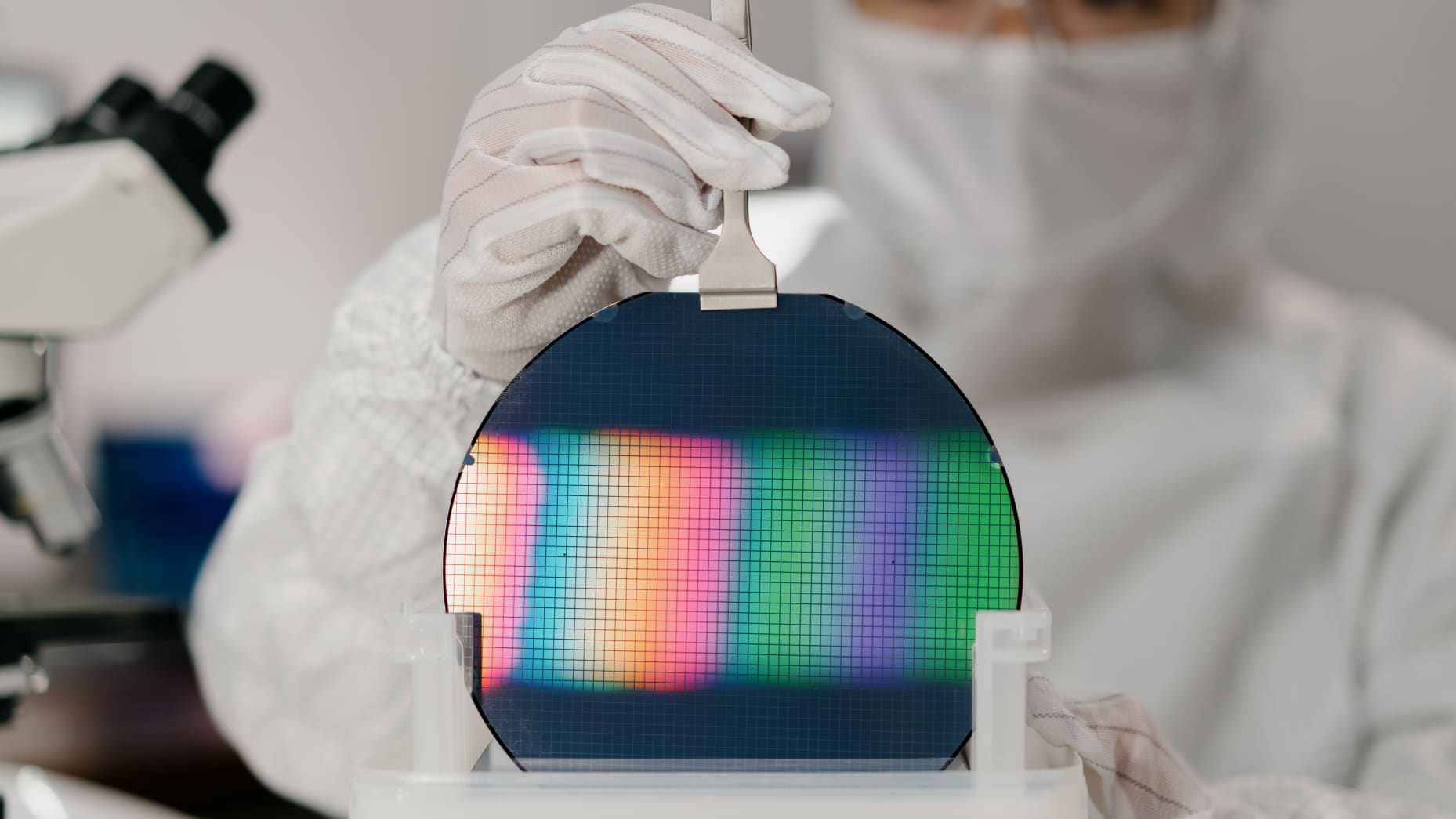

AI chip fabrication

The manufacturing side of AI chips hinges on access to advanced fabrication facilities and the critical manufacturing equipment that enables the production of cutting-edge GPUs and other accelerators. The heart of the matter is that Nvidia relies on a leading contract chipmaker to produce its most advanced chips, with the world’s premier foundry being a company based in Asia. This foundry adheres to stringent export-control regimes and is prohibited from accepting orders from certain restricted companies on U.S. trade lists. Huawei, for instance, has faced restrictions since being placed on export control lists several years ago, which limits its access to the most advanced production technologies.

This set of constraints has driven Chinese chip designers to seek domestic fabrication capabilities and to partner with local foundries. The largest homegrown foundry is a company that has built up capacity to produce semiconductors at a node that is less advanced than the most cutting-edge processes but still crucial for many applications. The broader picture shows a clear gap: while the leading global foundry (the one most associated with Nvidia’s high-end processes) operates at 3-nanometer and beyond, the domestic alternative in China has historically operated at larger nodes, although progress toward smaller nodes has accelerated in recent years.

One critical gap in China’s fabrication capabilities is process technology. The domestic foundry currently excels in mid-range process nodes but has yet to match the performance, power efficiency, and density of the tier-one leaders who produce at 3-nanometer and smaller. The 7-nanometer node—still highly capable for various applications—indicates progress but also reveals that mass-producing advanced GPUs at scale requires continued investment and technology licensing. The struggle to achieve 3-nanometer devices at commercial yield levels underscores a fundamental challenge: achieving parity with the world’s leading foundries requires not only process mastery but also the supply chain, equipment, and materials that support those nodes.

Industry observers have noted that the domestic capacity to mass-produce advanced GPUs locally remains constrained by several factors. First, the most advanced lithography equipment necessary for sub-10-nanometer processes is tightly controlled by Western suppliers. Second, the availability of key raw materials, specialized chemicals, and high-purity wafers can be limited by export policies and trade restrictions. Third, packaging and testing capabilities must scale in tandem with wafer fabrication to ensure reliability and performance in AI workloads. Each link in this chain must be resilient and capable of achieving high yields to meet domestic demand as well as potential exports.

A leading analyst explains that while domestic designs like Huawei’s Ascend chips are technically strong in architecture, the ability to fabricate them at scale with competitive yield remains a chokepoint. Huawei and other Chinese players have made significant progress, including demonstrations of domestic fabrication capabilities and collaborations aimed at expanding capacity. Yet the expert notes that the current state of domestic manufacturing cannot yet fully replace the global leaders in advanced node production, particularly for high-performance AI accelerators.

There is evidence of incremental progress in domestic fabrication capabilities. For example, a Chinese company known for research and development in lithography has been associated with efforts to advance lithography technology. The broader strategy appears to emphasize long-term technological independence by investing in alternative lithography methods and process nodes, rather than simply replicating existing Western equipment. This approach seeks to reduce exposure to export controls by diversifying the supply chain and investing in in-house capabilities where possible.

Nevertheless, the fabricating side faces a persistent reality: even as domestic design grows more capable, the step from design to production remains fraught with risk and complexity. The 7-nanometer and 5-nanometer milestones are not mere marketing labels; they reflect real, tangible steps in miniaturizing transistors, reducing leakage, and elevating performance per watt. Reaching these milestones domestically requires not only advanced process technology but also a seamless ecosystem of equipment, materials, and high-precision manufacturing. The path to domestic parity with Nvidia-level production remains long, with multiple technical, economic, and policy considerations shaping the pace of progress.

In summary, AI chip fabrication in China has moved beyond a purely speculative phase to deliver tangible, incremental advances. The domestic foundry landscape, led by SMIC, has demonstrated capability at nodes that enable a wide range of applications, including AI accelerators. Yet the U.S. export controls, allied restrictions, and the reliance on foreign equipment and materials for the most advanced nodes underscore the ongoing challenge: achieving mass production of state-of-the-art AI chips at commercial scale without sustained access to critical equipment and process technologies, at least in the near term, remains a central hurdle for China’s AI ambitions. The industry’s trajectory will likely hinge on continued investment, technology licensing, and the maturation of domestic fabrication capabilities that can operate at competitive yields and levels of cost efficiency.

Subsection: The SMIC path and its implications for China

The domestic foundry landscape, with SMIC as a leading player, illustrates the challenges and potential of China’s fabrication ambitions. SMIC’s reported capability to produce 7-nanometer class chips marks a notable milestone relative to earlier generations, yet it stands well short of the 3-nanometer and below processes that define the most advanced AI accelerators. The difference in process nodes translates into substantial advantages in density, performance, and energy efficiency, which are crucial for AI workloads that demand sustained throughput and scalable memory bandwidth.

Analysts note that SMIC faces significant headwinds as it seeks to push into more advanced nodes. While the company appears to have made progress, the constraints imposed by export controls on equipment and materials necessary for sub-7-nanometer processes create natural barriers. The expected path for SMIC involves incremental improvements in existing nodes and targeted moves toward smaller nodes as technology licensing and access to equipment become more feasible through geopolitical shifts, partnerships, and the global semiconductor market’s evolving landscape. The pace of this progression will be shaped by how quickly the domestic ecosystem can secure access to essential tools, software libraries, and process know-how that enable high yields and cost-competitive production.

A broader takeaway is that SMIC’s development, while significant, remains a bridge—the bridge between a domestic design capability and broad, scalable manufacturing at the most advanced nodes. The vision of a fully self-sufficient, leading-edge AI semiconductor manufacturing base in China will require sustained investment, expanded collaboration with domestic suppliers, and a longer-term strategy to harmonize policy, trade, and technology transfer. The country’s policymakers recognize that a diversified, resilient supply chain must integrate not only chip fabrication lines but also packaging, testing, and materials supply chains that collectively determine the ultimate competitiveness of Chinese AI accelerators on the global stage.

Advanced Chip equipment

A central bottleneck in China’s ambition to build a competitive AI ecosystem is access to advanced chipmaking equipment. The Netherlands hosts the world’s leading supplier of state-of-the-art lithography systems, a company that designs and manufactures the tools essential for printing tiny, intricate circuit patterns onto silicon wafers. The export controls implemented by the United States and its allies restrict the sale of the most advanced ultraviolet lithography machines to China, which materially limits the ability of Chinese fabs to produce chips at the most advanced process nodes. This limitation has a cascading effect: even with domestic design talent and some fabrication capacity, the absence of top-tier lithography equipment constrains scaling to the most demanding AI workloads that drive powerful accelerators.

The lithography bottleneck is widely acknowledged by industry observers as the pivotal challenge to achieving 3-nanometer and sub-3-nanometer production in China. Lithography equipment—especially EUV (extreme ultraviolet) lithography—plays a critical role in enabling the high-density transistor patterns required for the smallest process nodes. With EUV restricted for export, Chinese manufacturers have leaner options, relying on less advanced deep ultraviolet lithography systems. While these DUV tools enable working at larger nodes and have supported significant production, they do not match the efficiency and density benefits of EUV-enabled processes. The gap translates into higher costs, lower yields, and more complex thermal management in AI accelerators.

Analysts emphasize that the absence of EUV remains a persistent and formidable obstacle. They point to the fact that even when domestic firms substitute with alternative lithography techniques, the performance parity with the world’s leading nodes remains elusive. The limitations of DUV lithography include reduced printability of fine features and lower process fidelity, which cascades into lower yields, higher manufacturing costs, and longer development cycles. As a result, the domestic ecosystem remains encumbered by a dependency on foreign equipment to achieve state-of-the-art performance.

In response to these constraints, Chinese companies and researchers are pursuing a multi-pronged approach to lithography independence. One path involves collaborating on alternative lithography technologies and process innovations that may bypass some dependency on EUV. This strategy includes exploring new materials, resist formulations, and exposure techniques designed to maximize resolution within the constraints of available hardware. In addition, there is an emphasis on improving the efficiency and reliability of using older lithography systems to extend their useful life and maximize yields, a tactic that can provide time for the country to build a more robust domestic toolchain.

The domestic response also includes efforts to enhance design-for-manufacturability (DFM) and yield optimization that help offset some limitations in lithography equipment. Through advanced process control, metrology, and defect reduction, Chinese teams aim to extract more performance from existing tooling while preparing for the eventual deployment of next-generation equipment. The long-term objective is to reduce the gap between domestic manufacturing capabilities and those of the world’s leading producers, ultimately enabling China to scale AI accelerators with comparable efficiency and cost structures.

SiCarrier Technologies, a Chinese firm specializing in lithography technology development, has emerged as a noteworthy player associated with Huawei in the broader lithography conversation. While the specifics of collaborations remain opaque, industry observers recognize that domestic firms are building the capability to adapt and improve lithography technologies, which could yield incremental gains in the future. The broader takeaway is that China’s quest for lithography independence is ongoing, with multiple research and development threads converging to create a more resilient domestic toolchain over time.

However, even with these efforts, a critical reality remains: imitating existing lithography systems is unlikely to deliver rapid, comprehensive parity with the most advanced equipment. Analysts warn that attempting to replicate EUV directly would require decades of investment and complex technology transfers that are unlikely in the near term. Instead, China is likely to pursue complementary advances—approaches that enable alternative manufacturing pathways and novel lithography techniques, as well as new materials and process integrations—that could gradually raise domestic capabilities without attempting an exact replica of Western lithography hardware.

A key strategic question is whether China can achieve meaningful gains in lithography via a combination of improved domestic tooling, accelerated R&D, and selective licensing. The path toward meaningful independence in advanced chip manufacturing is not a single leap but a sequence of incremental improvements across equipment, process technology, and supply chain resilience. The result could be a more diversified and robust environment for AI accelerators, even if it does not immediately eliminate reliance on foreign equipment for the most advanced nodes.

Subsection: The broader supply chain and equipment resilience

Beyond lithography, other essential pieces of the advanced manufacturing puzzle include deposition tools, etching systems, chemical mechanical polishing, and packaging and testing equipment. Each category plays a crucial role in delivering high-performance chips at scale. The United States and its allies have worked to restrict the export of multiple classes of advanced manufacturing equipment to China, and the net effect is a more complex, longer path for domestic firms to assemble an end-to-end capability that mirrors the global leaders.

In China’s strategic response, there is a clear emphasis on domestic innovation, diversification of suppliers, and the development of alternative technologies that can provide similar outcomes without depending on restricted categories of equipment. This approach aims to create a more resilient ecosystem that can withstand geopolitical risk and supply chain disruptions. The ultimate objective is not merely to replicate a single tool but to cultivate a broader, integrated manufacturing capability that can deliver competitive AI accelerators in the years ahead.

As these efforts unfold, the industry remains mindful that the most critical enabler of sophisticated AI chips is—not surprisingly—an integrated and reliable end-to-end supply chain. Achieving this requires not only advanced lithography machines but also the ecosystem of materials, consumables, and process knowledge that supports consistent, high-yield production. The interplay of policy, geopolitics, and technology ultimately shapes the pace at which China can achieve more autonomous manufacturing capabilities for AI accelerators and related devices. The road ahead is long, but the accumulated momentum across design, fabrication, and equipment domains signals a deliberate, if cautious, march toward a more self-sufficient AI hardware stack.

AI memory components

While GPUs are the most visible component of AI hardware, memory components—particularly high-bandwidth memory (HBM)—play an equally critical role in enabling high-performance AI training and inference. HBM, a dense memory technology that delivers high bandwidth with lower power per bit, has become the industry standard for many high-end AI accelerators. In this space, South Korea’s SK Hynix has emerged as a leading memory supplier, alongside global peers such as Samsung and Micron. The availability of HBM, along with the broader supply chain for memory and related packaging, is essential for delivering the performance required by contemporary AI workloads.

Analysts emphasize that high-bandwidth memory remains a pivotal component in the AI chip ecosystem. High-bandwidth memory enables rapid data movement within accelerators, a critical capability for training large neural networks and running complex inference tasks. The speed with which memory components can keep up with processing elements has a direct impact on overall AI system performance and efficiency. As AI models continue to scale, the importance of memory subsystems cannot be overstated.

In China, the memory landscape includes domestic players seeking to catch up with global leaders in HBM production. South Korea’s HBM leader and other major memory manufacturers have tightened export controls on certain HBM products to China in the context of broader restrictions, intensifying the need for domestic memory development. In response, Chinese memory firms have embarked on ambitious projects to develop HBM technology within the country. A notable effort involves ChangXin Memory Technologies (CXMT), in collaboration with Tongfu Microelectronics, to embark on early-stage HBM production. While CXMT is at an early stage in HBM development, its involvement signals the Chinese government’s intent to cultivate domestic memory supply capabilities that could eventually support AI accelerators at scale.

Analysts estimate that CXMT’s HBM development is still several years behind the global leaders. Estimates vary, with some suggesting three to four years behind established leaders in HBM, given the current export-control environment and the challenges of building a full domestic ecosystem for memory. CXMT faces significant hurdles, including access to specialized memory manufacturing equipment, lithography-grade materials, and advanced packaging solutions. The path toward domestic HBM production involves not only wafer fabrication but also the packaging, testing, and integration that are essential for delivering memory with the required bandwidth and reliability for AI workloads.

In parallel, Wuhan Xinxin Semiconductor Manufacturing (Wuhan Xinxin), a Chinese foundry, has reportedly begun building a facility to produce HBM wafers. While Huawei has been linked to the firm in producing HBM chips, these reports were not confirmed publicly. Nevertheless, these developments point to a broader push to diversify and strengthen China’s memory supply chain. Huawei’s Ascend GPUs for AI workloads rely on HBM stockpiles from suppliers like Samsung for certain configurations, illustrating the continuing importance of foreign memory components in the short term. Even as domestic projects advance, Huawei’s AI processors in some configurations may continue to leverage external memory resources, underscoring the current interdependence between domestic design and foreign memory inputs.

Analysts highlight several challenges facing China’s memory ambitions. Export controls on chipmaking equipment and packaging technologies present a meaningful constraint on the pace at which CXMT and other domestic memory players can scale. The ability to achieve reliable, high-volume HBM production requires not only wafer fabrication capacity but also advanced packaging and testing capabilities, which have traditionally been a strength of global memory leaders. The governance of supply chains for memory—ensuring access to the essential materials, wafers, and packaging components—remains a critical risk that could slow domestic progress.

On the demand side, Chinese memory developers must ensure the performance of domestic HBM stacks matches the needs of AI accelerators, which demand extremely high bandwidth with strict latency and power constraints. The integration of HBM with domestic GPU designs or accelerators must pass through rigorous validation, including memory-curtailing tests, error detection and correction, and long-term reliability testing under AI workloads that stress memory bandwidth. The collaboration between memory vendors and accelerator designers must be deep and well-coordinated to achieve seamless operation and robust performance.

In addition, the broader geopolitical environment will influence China’s memory strategy. Foreign suppliers including memory manufacturers and packaging specialists may respond to export restrictions with protective policies, potentially limiting the availability of critical components for domestic memory development. Chinese policymakers and industry leaders recognize that achieving a self-sufficient memory supply chain is a multi-year, multi-faceted endeavor that will require investment, research, and cross-sector collaboration. This strategy includes not only the creation of domestic memory production facilities but also the formation of robust partnerships with universities, research institutes, and multinational hardware manufacturers that can contribute to the development of HBM technology within the country.

A key takeaway is that memory components, especially HBM, are an essential but challenging area for China’s AI hardware strategy. The domestic memory sector is making progress, but current capabilities lag behind global leaders, and the reliance on foreign memory inputs in certain configurations persists. The combination of export controls, complex packaging requirements, and the technology gap in both wafer fabrication and memory stacking means that domestic HBM production will continue to evolve as a critical focal point of China’s broader pursuit of self-reliant AI hardware.

Subsection: CXMT, CXMT’s HBM roadmap, and the packaging challenge

CXMT’s effort to advance HBM technology marks an important step in China’s attempt to close the memory gap. The company, working alongside Tongfu Microelectronics, is in the early stages of HBM development, seeking to produce high-bandwidth memory domestically. However, experts caution that CXMT’s progress faces a crowded field of established players with mature HBM offerings and well-developed supply chains. The gap in timing—three to four years behind global leaders—highlights the difficulty of catching up in this highly specialized, capital-intensive field. In the short term, CXMT is likely to focus on intermediate memory technologies and higher-bandwidth memory offerings that can address specific AI workloads, while laying the groundwork for more advanced HBM production in the longer run.

Packaging remains a significant hurdle for domestic HBM development. The integration of HBM with AI accelerators requires sophisticated packaging technologies that deliver high interconnect density with minimal signal loss and thermal concerns. Domestic players must either invest in new packaging capabilities or partner with foreign firms to ensure high-quality packaging solutions. The path to a self-sufficient memory ecosystem thus hinges not only on wafer fabrication but also on mature, scalable packaging and testing infrastructure capable of delivering the performance characteristics demanded by AI workloads.

In parallel, Wuhan Xinxin’s expansion in HBM wafer production signals a broader shift toward domestic capacity-building beyond memory die fabrication. This expansion, if realized, could help address supply constraints in the Chinese market and create a more integrated domestic pipeline that connects wafer fabrication with memory stacking in a localized ecosystem. The potential benefits include reduced lead times, improved supply chain resilience, and better alignment with national AI strategy goals. However, the realities of global competition and the need for cutting-edge process technology suggest that the domestic memory journey will be gradual and incremental, with occasional milestones that demonstrate practical progress rather than immediate parity with global leaders.

On the user-side, Huawei’s Ascend 910C and other AI accelerators might rely on imported HBM stockpiles for certain configurations, illustrating a temporary reliance on foreign memory inputs even as domestic efforts advance. The broader objective remains to reduce this dependency and develop a self-sufficient memory supply chain capable of supporting a wide range of AI workloads without compromising performance or reliability. Achieving this will demand a sustained, collaborative effort across memory manufacturers, packaging specialists, and chip designers, supported by policy incentives and strategic funding aligned with China’s long-term AI ambitions.

Huawei and the domestic AI ecosystem: progress, challenges, and strategic bets

Huawei has emerged as a central figure in China’s effort to build a self-sufficient AI semiconductor ecosystem, especially in design and the development of in-house accelerators. HiSilicon’s Ascend family represents a concerted push to diversify away from external dependencies and to cultivate domestic capabilities in both design and, to a degree, fabrication. While progress is evident, the path to full independence remains layered with technical, policy, and supply-chain complexities. Huawei’s strategy reflects a broader national objective: to wed strong domestic design with gradually expanding manufacturing capabilities and to cultivate a robust AI hardware ecosystem that can sustain domestic AI workloads and, potentially, export to international markets under favorable geopolitical conditions.

Huawei’s Ascend GPUs have evolved to address a range of AI workloads, including training and inference for large-scale models. The Ascend line’s evolution demonstrates Huawei’s commitment to building a competitive AI accelerator stack capable of competing with global leaders in environments where access to foreign suppliers is constrained. The company’s emphasis on domestic design capabilities aligns with broader national goals to strengthen sovereignty in strategic technologies, including semiconductors. The progress represented by the Ascend 910 family is meaningful, signaling a step toward a more capable domestic AI hardware platform that can operate effectively within China’s evolving regulatory environment.

Despite the strides, Huawei continues to rely on foreign inputs for certain critical components, including memory and, for now, some packaging and foundry capabilities. This reliance underscores the complexity of constructing a fully domestic AI silicon stack, given the importance of a seamless end-to-end supply chain. Huawei’s partnerships with Chinese memory producers, domestic packaging specialists, and local silicon suppliers—where feasible—reflect a deliberate strategy to gradually reduce dependence on external sources while maintaining performance and reliability across AI workloads. The balance between domestic development and international collaboration remains a central theme in Huawei’s strategy.

A broader assessment suggests that Huawei’s progress exemplifies both the potential and the constraints of China’s domestic AI ecosystem. The company’s advancements in GPU design and AI-specific silicon contribute to the country’s broader objective of self-reliance, yet the absence of complete parity with the world’s leading AI accelerators in the most advanced functional areas highlights the need for sustained investment across all segments—design, fabrication, memory, and packaging. Huawei’s role—combined with the country’s policies, incentives, and long-term investment plans—indicates that China is pursuing a multi-stage strategy: first, reduce exposure to export controls by advancing domestic capabilities; second, broaden the base by cultivating a larger pool of domestic designers and fabs; third, pursue strategic collaborations that maintain access to essential inputs like memory, wheels for packaging, and specialized equipment where feasible.

Looking forward, Huawei’s strategy will likely continue to emphasize strengthening in-house design while expanding domestic manufacturing capacity and ecosystem partnerships. The company’s role in pushing the boundaries of domestic AI silicon will depend on a combination of policy support, technology licensing, and the ability to attract talent and investment into the sector. The broader national goal is to realize a resilient AI semiconductor supply chain that can withstand external shocks and reduce reliance on foreign technology for critical components. This challenge requires not only technical breakthroughs but also a well-coordinated policy framework, targeted funding, and sustained collaboration with industry, academia, and global partners where permissible.

Subsection: The policy and market dynamics shaping Huawei’s roadmap

Policy considerations shape Huawei’s roadmap in several ways. The Chinese government’s broader aim to reduce strategic vulnerability in high-technology sectors drives targeted support for domestic AI hardware development, including funding for research, incentives for local manufacturing, and initiatives to foster a robust domestic supplier ecosystem. Market dynamics, including demand from large enterprises and government agencies for AI capabilities and the need for data sovereignty and security, further reinforce the push toward domestic AI hardware.

The geopolitical environment, including export-control regimes and sanctions, directly influences Huawei’s strategic calculus. Huawei must navigate a landscape in which access to advanced fabrication tools, memory inputs, and packaging capabilities may be constrained by external policy decisions. In response, Huawei and other Chinese players pursue a dual strategy: invest in domestic capabilities wherever feasible and cultivate international partnerships that remain permissible under current rules. This approach aims to create a more self-reliant supply chain while preserving flexibility to adapt to evolving geopolitical conditions.

Subsection: Building a self-sustaining ecosystem: challenges and opportunities

The journey toward a self-sustaining AI hardware ecosystem is a long-term endeavor that requires investments across multiple domains. Among the most critical factors are the following:

- Design excellence: China is investing in domestic AI accelerators and GPU designs that can compete with leading global products in a range of workloads, alongside the software ecosystems, compilers, and developer tools that enable efficient use of these chips.

- Fabrication capability: The path to domestic mass production of cutting-edge AI chips depends on access to advanced lithography, metrology, and process technology, as well as the capacity to scale manufacturing with high yields.

- Equipment and materials: Building a resilient supply chain for manufacturing equipment, materials, and packaging is essential to reduce reliance on foreign suppliers and to mitigate risk from global policy shifts.

- Memory and packaging: The ability to develop domestic memory (HBM) capabilities and advanced packaging is critical for achieving high-speed AI systems with robust thermal and power management.

- Talent and collaboration: A sustained focus on talent development in hardware design, software tooling, and manufacturing, coupled with strategic collaborations, is necessary to accelerate progress and shorten the time to market for competitive AI accelerators.

The English across these pillars highlights the importance of a holistic approach: even as design capabilities advance, the ability to scale to mass production, achieve competitive performance, and maintain cost efficiency depends on connected progress across fabrication, memory, packaging, and the ecosystem that supports hardware execution. Huawei’s experience demonstrates the interplay between corporate innovation and national policy in shaping outcomes for AI hardware in China.

Conclusion

The U.S.-led export controls have reshaped China’s AI hardware ambitions by accelerating domestic development while exposing persistent gaps across design, fabrication, memory, and equipment. The strategic emphasis on Huawei’s HiSilicon, SMIC’s foundry capabilities, and the broader domestic memory and lithography programs signals a deliberate, long-term effort to diversify away from foreign dependencies. While China has demonstrated notable progress—particularly in AI chip design and the maturation of domestic accelerators such as Huawei’s Ascend family—the path to parity with the world’s leading AI chips remains challenging and multi-faceted.

The most visible progress lies in design: Huawei’s Ascend GPUs show meaningful advancements in domestic chip architecture, narrowing gaps with export-restricted Nvidia offerings. However, consistent access to the most advanced process nodes and the full end-to-end stack—fabrication, advanced lithography, packaging, and memory—remains constrained by external policy regimes. The fabrications ecosystem, represented by SMIC, has achieved notable milestones but still lags the global leaders in process technology, yield optimization, and large-scale production at the most advanced nodes. The lithography landscape underscores a critical bottleneck: EUV and other leading-edge tooling remain under export controls, forcing China to pursue alternative approaches and strengthen domestic capabilities in lithography research and process innovation while managing the risk of slower scaling.

Memory, particularly HBM, stands as another major frontier. While CXMT’s early strides in HBM development signal movement toward a domestic memory supply, the overall capability to produce high-bandwidth memory at scale remains a work in progress. The reliance on foreign memory inputs—whether from Samsung or other suppliers—for certain configurations illustrates the structural dependency that China seeks to reduce. Building a fully self-sufficient memory supply chain will require advances in wafer fabrication, high-density packaging, and integrated testing, along with policy support that fosters innovation and investment across the entire memory ecosystem.

In sum, China is methodically advancing toward a more autonomous AI hardware stack, with Huawei playing a central role in design and ecosystem formation, and domestic players increasingly contributing to fabrication, lithography research, and memory development. The journey is incremental, with meaningful milestones achieved along the way, yet the most advanced AI chips, at scale and with the full performance envelope demanded by cutting-edge AI workloads, will likely require sustained, long-term collaboration across policy, industry, and research communities. The coming years will reveal whether these concerted efforts can close the remaining gaps and enable a resilient, domestically oriented AI semiconductor supply chain capable of competing with the world’s leading accelerators on a broad set of AI tasks.